Quiet Luxury vs. Conspicuous Consumption

Furniture World News Desk on

7/9/2024

A New York minute ago, quiet luxury replaced conspicuous consumption and became all the rage. Now it’s

retreated from the headlines with fashion insiders rejecting the phrase as too overused: “An overly

TikTok-ified way of describing classic, refined clothing,” the Wall Street Journal reports. Italian designer Brunello Cucinelli, who fully

embraces the trend if not the terminology, prefers the phrase “gentle luxury.”

No matter what you call it, luxury that is quiet, gentle, and inconspicuous is shaping the near future for luxury

brands. The trend is marked by downplayed elegance, along with the traditional requisites of expert tailoring and

craftsmanship, the highest-caliber fabrications and materials, and elevated personalized service. Quiet luxury

renounces prominent logos and ostentatious displays of wealth by embracing the understated luxury fundamentals of

quality with a capital “Q.”

Yet, under the surface, the status that luxury brands represent still exerts a strong pull for many consumers –

if not most. Entitlement and social status, referring to one’s rank or position within the social hierarchy,

play a pivotal role in one’s self-identity. Owning and wearing luxury brands is an outer-directed expression

of personal identity and values.

In other words, identity has both intrinsic (self-expression) and extrinsic (status) components. As Chris Gray, the

Buycologist, says, “Luxury purchasing is an interplay of status and self-expression, not either/or, but both.

The brands you buy reinforce your sense of self within different social contexts and situations. Nobody will look

down on you for buying something for quality. Unlike status, quality is the one people will fess up to.”

Fulfilling Psychological Needs

INSEAD Professor David Dubois, author of “Fulfilling Social Needs Through Luxury Consumption” has done

extensive research into luxury consumer behavior and motivations. He explains that two conflicting motives are at

work in purchasing luxury items.

- Differentiation: The desire to differentiate oneself, “to be exclusive; to be different; to disassociate

themselves from the common herd”

- Assimilation: The drive to assimilate by aligning or “branding” oneself as a member of the in-group

While the assimilation motive might seem to pertain primarily to those seeking to climb the social ladder,

there’s safety in numbers and even those at the top of the ladder want to fit in with their tribe. Social

signaling is a primary motive for everyone up and down the social hierarchy.

Shifting Tides

Conspicuous consumption and its polar opposite, quiet luxury, ebb and flow in a predictable pattern as the economy

fluctuates. When times are good, the restraints come off and louder luxury brands are in vogue, as during the period

following the 2008-2009 global recession. Gucci, Balenciaga, Michael Kors and Burberry crested the conspicuous

consumption wave only to crash recently.

When the economy goes south, quiet luxury comes back into vogue. Brunello Cucinelli and Prada are riding that wave,

up 24 percent and 10 percent respectively last year. Though tucked away within LVMH’s Fashion and Leather

Goods reporting segment, quiet luxury brands Celine, Dior and Loro Piana are thriving. While Hermès’

Birkin and Kelly bags have ultra, top status-symbol ranking, the company maintains strict control of distribution,

so Hermes’ exclusivity keeps the brand quiet.

Some brands, like Louis Vuitton, seem to have enough bandwidth to flow whether the tide is rolling in or out, but

many others can get caught in a rip current when the tide turns.

Psychological Underpinnings

Dynamic growth in the luxury market and across cultures where different social norms apply makes it particularly hard

for brands to calibrate their offerings to the current tides. Since 2019, Bain reports the personal luxury goods segment has advanced nearly 30

percent, up from roughly $300 billion (€281 billion) to $400 billion (€362 billion) in 2023. Bain expects

it to reach between $585 to $629 billion by the end of the decade, so the tidal shifts will be even more dramatic.

“With the proliferation of luxury across diverse segments and markets, luxury consumption has taken on diverse,

novel, and sometimes unexpected forms – within the traditional luxury domain, beyond traditional luxury, and

even outside the realm of consumption altogether,” Professor Dubois observed in another paper studying the status-seeking

dynamic in luxury consumption.

He wrote that consumers with less experience in the luxury realm, those he calls “luxury excursionists,”

are typically from lower-economic tiers. They lean toward conspicuous consumption with prominent luxury logos. Those

with greater luxury expertise tend toward quiet luxury brands “to disassociate themselves from the

mainstream.”

That’s the general rule yet segmenting the target market for quiet versus loud luxury brands by traditional age

or income demographics is difficult. For example, one’s political leanings align with their status-seeking

behaviors. Wealthy conservatives tend to rely more on luxury brands to affirm their social status, i.e., conspicuous

consumption, while liberals prefer to buy unique, creative quiet luxury brands or experiences to distinguish

themselves. “In sum, conservatives want to be ‘better than;’ liberals want to be ‘different

from,’” he observes.

Whether conservative or liberal, high-status individuals may reject brands that become too popular whether

logo-emblazoned or not. This could put Louis Vuitton at risk as its classic, logo-heavy Neverfull canvas tote

bags are ubiquitous. Luxury resale sites like The RealReal and Vestiarie Collective have made many hitherto

out-of-reach luxury brands accessible to the masses. Now anyone with enough disposable income can afford a piece

of luxury.

Add to that, high-net-worth consumers may turn their noses up at brands using aggressive marketing tactics believing

them to be trying too hard. Then there’s also the danger of leaning too heavily on influencers and celebrity

spokespeople. Established high-status consumers march to their own drummer and don’t follow the crowd, while

younger consumers tend to be more influenced by influencers. But that may change as they mature.

Luxury is an Attitude

Dubois points out that high-status individuals are increasingly looking beyond traditional luxury goods brands in

pursuit of greater personal differentiation. This he calls “non-consumption” behaviors, i.e.,

experiential luxury, such as “investing in physical and affective resources to acquire cultural capital and

status recognition that were traditionally attained through luxury.”

In 2023, experiential luxury, such as hospitality, fine dining, and cruises, grew 15 percent year-over-year, as

compared with traditional luxury personal and home goods, which advanced only 3 percent. In addition, what Bain

defined as “experienced-based goods,” including fine art, luxury cars, private jets and yachts, fine

wines and spirits, and gourmet food, rose 10 percent.

Indulging in such non-consumption luxuries is more likely to yield admiration and envy from one’s social group,

while Dubois warns of potential negative consequences of consuming and displaying luxury goods in other social

contexts. “This dark side of luxury consumption merges at the psychological, social, and economic

levels,” he maintains. These include:

- Feelings of being inauthentic as conspicuous consumption displays can reflect undue privilege and give people a

feeling of “hubristic pride, which is often viewed as antisocial and selfish.” This can make people

feel some portion of shame and guilt when purchasing expensive luxury goods. He also notes that these conflicted

feelings particularly impact high-income luxury owners, perhaps because of their awareness of income inequality.

- On the social or interpersonal level, luxury consumers are perceived as less warm and friendly, making them less

attractive as new friends. These perceptions may negatively impact those working in

“warmth-oriented” or service job settings, creating a hurdle for luxury brands’ in-store

personnel. Further, luxury consumers may be viewed negatively as more wasteful and materialistic. And it can

harm women on the dating front because it signals to potential mates, she has high financial expectations.

- Luxury goods brands can face potential economic blowback from these negative psychological and social dimensions

by diluting the brand’s appeal, a particular vulnerability as brands get too big and conspicuous.

“Luxury brand executives increasingly need to learn about an expanding number of factors that interact –

and possibly conflict – in shaping consumption,” Dubois warns, adding, “The vehicles of the

pursuit of status constantly change in step with evolving norms and values that prevail in specific groups or at

specific points in time.”

Status Sells

In surveys, luxury consumers give various reasons why they buy luxury brands, typically those considered socially

acceptable, like quality, durability, and craftsmanship. Few own up to status as a primary driver, yet Dubois’

research shows status signaling is a powerful drive for luxury purchases. “Consumers’ enduring desire

for luxury largely derives from the need for status, that is respect, admiration and voluntary deference afforded by

others.”

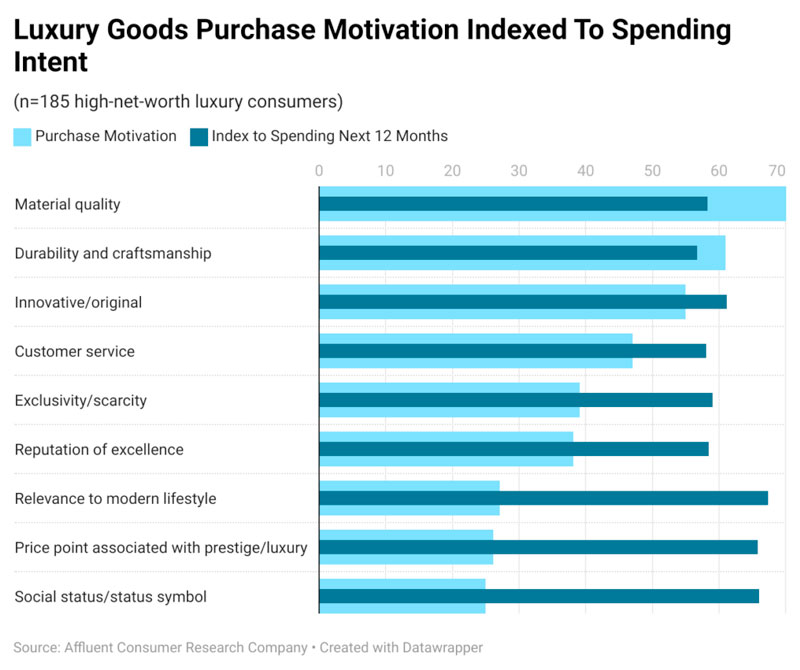

That drive is underscored by a recent survey by the Affluent Consumer Research Company (ACRC). When high-net-worth

consumers were asked about the traits or qualities they expect from luxury brands, the majority responded with

material quality (70 percent), durability/craftsmanship (61 percent), and innovation/originality (55 percent).

Bringing up the rear were status and prestige associated with price point, at 25 percent and 26 respectively.

Yet when calibrated with consumers’ luxury purchase intent, status, prestige, and a brand’s relevance to

a modern lifestyle, perhaps reflecting relevance to popular trends like quiet luxury, all were a far greater

predictor of spending intention than other qualities.

ACRC’s lead researcher Chandler Mount stresses the difficulty in untangling consumers’ status motivations

in surveys. “It’s tricky because consumers (and segments of consumers) may view status differently

depending on the context. It could be a purchase driver for something visible like a car or clothing, but it could

be an invisible driver for an experience like travel.”

Walking a Fine Line

No matter how it’s measured, the status value associated with luxury brands can’t be underestimated. It

has a strong and enduring power, but it also creates tensions for consumers. “Our analysis of the drivers

fueling the desire for luxury revealed this desire often stems from conflicting motives. At the heart of it is the

need for status, a deeply ingrained and often unconscious force guiding thoughts, feelings and behavior about luxury

brands,” Dubois stresses and warns luxury brands to walk a fine line to understand the conflicts and help

resolve them.

“We found a common thread: the idea that the drivers, forms, and consequences of luxury consumption – all

three dynamic elements of purchases – involve tensions requiring great finesse on the part of luxury brands as

they try to approach, communicate with, and ultimately retain clients,” he concludes.

Note: This article originally appeared in The Robin Report.

About Pam Danziger

Pamela N. Danziger is an internationally recognized expert specializing in consumer insights for

marketers targeting the affluent consumer segment. She is president of Unity Marketing, a boutique marketing consulting

firm she founded in 1992 where she leads with research to provide brands with actionable insights into the minds

of their most profitable customers.

She is also a founding partner in Retail Rescue, a firm that provides retailers with advice, mentoring and

support in Marketing, Management, Merchandising, Operations, Service and Selling.

A prolific writer, she is the author of eight books including Shops that POP! 7 Steps to Extraordinary Retail

Success, written about and for independent retailers. She is a contributor to The Robin Report and Forbes.com. Pam is frequently called on to share new insights

with audiences and business leaders all over the world. Contact her at pam@unitymarketingonline.com.