Your long-term business success largely boils down to two critical elements; Margins and

Sales Growth. Margins determine how much a business has left over to pay for operating costs and yield a profit to produce cash. Margins are key to achieving viable retail sales levels.

If a furniture or mattress retailer with total retail sales of $10,000,000 per year is making 50 percent gross margin on its financials, is it performing well?

You may think so. But, the truth is, maybe not.

It depends if the business is leaving anything on the table. Could it be performing better in any particular area? The question we will examine in this article is: Does Total Gross Margin after all Costs of Goods Sold are deducted, give a full performance picture?

I don’t believe it does. There is a better approach: Realized Gross Margin.

A Better Approach

Using the example of a hypothetical $10 million company (we will call XYZ furniture), let's look first at how a lot of home furnishings retailers calculate their top-line performance.

Checking the figures in Table #1 on the following page you can see that this company has $5.05 Million after the costs of its sales to pay for all operating costs, right?

Well, maybe, but likely not. This would only be true, if all sales transactions were physical cash. A big part of sales in retail comes with extra cost such as those incurred with financing third party, long-term and customer credit card debt. Any financing on sales comes with a direct cost to sales. Generally, the longer the term, the higher the cost to the business. These fees are not shown in Table #1. Instead, they are normally listed amongst day-to-day operating costs, and are not obvious.

This traditional way of top-line performance tracking (Table #1) lists all retail sales together. It is a correct way to do it accounting-wise. It does not, however, highlight the importance of the most profitable products that furnishings retailers often provide to their customers: Product Protection Plans. For this reason, businesses that I work with, separate protection sales and cost of sales from all other sales on their profit and loss statements. Protection sales are that important!

Realized Gross Margin Model

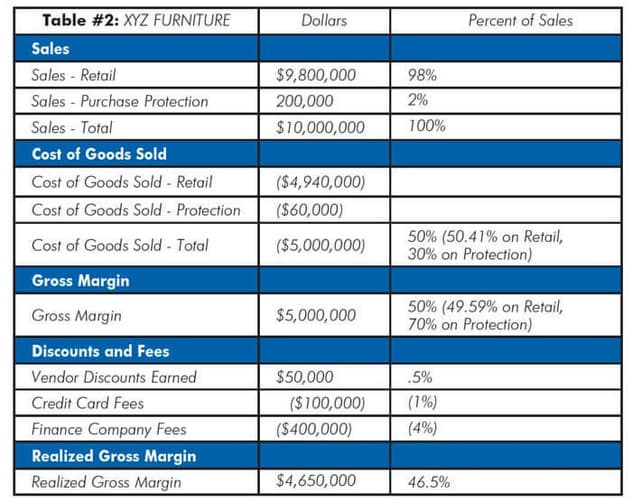

Here is how XYZ Furniture's $10 million business you reviewed in Table #1 might be evaluated using the Realized Gross Margin Model shown in Table #2.

You might say, “The results are the same. What’s the point?”

Technically you would be right. Bottom line, the results are the same. But the point is, that by tracking closely, rather than hiding critical metrics, there is an opportunity to improve bottom-line retail performance.

With the traditional method of tracking Gross Margin, XYZ's management might come to the assumption that top-line performance is excellent. Then, they might also wonder why their business is having difficulty producing a decent bottom-line profit.

Conversely, with the Realized Gross Margin method in Table #2, it becomes clear that after deducting non-employee, associated selling costs, margins are much less than originally thought. It is also clear that product protection produces a large share of gross margin percentage-wise.

So we now know that XYZ Furniture is an example of an under-performing operation on the top line that has an opportunity to dramatically improve in the following ways.

•The company should be getting a significantly greater percentage of sales and margin from selling protection plans.

- They could probably get a higher margin from retail sales.

- Finance fees overall could likely be reduced.

Protection margin should outpace finance and credit card costs. If this were the case, Realized Gross Margin would improve, as would XYZ Furniture's cash flow. This is all doable without negatively impacting sales. The business, in fact, would probably grow sales and margins simultaneously, due to a renewed focus on sales skills training for protection plans that would positively affect furniture sales.

Although I’m not going to go into detail here, sales commissions should also be looked at with respect to margin performance, even though they are not part of the Realized Gross Margin equation. This is due to the variable component of commission expenses.

Added Value Actions

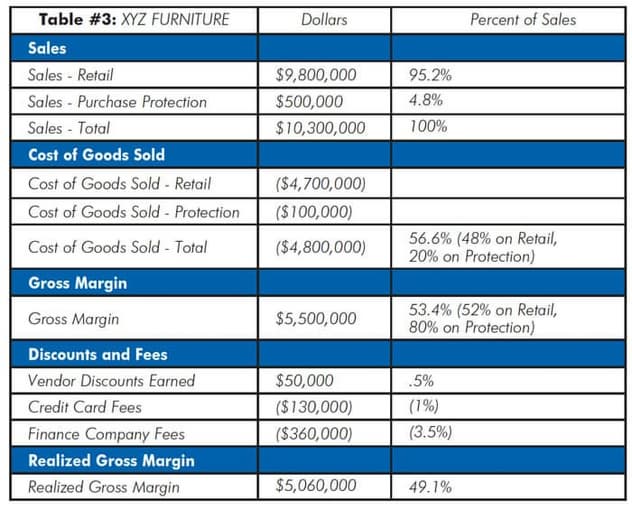

If this tracking helped lead to the value-added actions, we would likely see results like those shown in

Table #3 including:

- Retail sales are unaffected by selling a greater percent of product protection. This result would apply to all business models: High-end, special order, value-priced, contemporary, transactional-type, traditional.

- Four percent plus of a Furniture Store's volume should be from protection. Ten percent of sales volume is possible.

- Fifty-two percent Gross Margin on all retail furniture and mattresses has been proven obtainable through a variety of best practices.

- Eighty percent Gross Margin on protection should be the standard, given proper pricing schedules.

- Over 53 percent Gross Margin is achieved with this model.

- Credit card fees here are held constant at one percent of total sales for the purposes of this example.

- Finance company fees can be reduced using best practice merchandise and selling techniques discussed in earlier articles.

- The spread between protection and finance and credit card fees should add to Realized Gross Margin.

- Realized Gross Margins over 49 percent should be sought by all furniture and mattress operations. There are cases that land well over 50 percent, so there is room for improvement in XYZ Furniture's performance outlined in Table #3 .

Conclusion

In summary, expanding the traditional Gross Margin equation and tracking Realized Gross Margin, can highlight important improvement areas. By implementing a plan based on this information it is possible to produce top industry results to grab a greater share of every sales dollar being left over to produce profit. In this case that was 2.6 percent additional Realized Gross Margin produced with a $410,000 per year increase. Your case could be more or less than this, depending on your unique situation. Either way, I can guarantee you one thing: if you monitor Realized Gross Margin closely, you will find some untapped potential, and possible low-hanging fruit.