Supplier “X”, a new player in the home furnishings market, is largely unknown. Supplier "Y" is established with distribution throughout the marketplace. Which one do you choose?

It is all too common for retailers to choose suppliers solely based on "a look" they believe will sell well. It is true style that creates excitement on sales floors is critical, however, there are other key criteria that should be considered, and questions that should be asked of potential suppliers. Considering these will lead to higher profitability and inventory turns which is ultimately what businesses need if they want to outperform their competition.

30 Supplier Criteria

- The Right Look. Will the look improve your selection and increase excitement on your floor, given the likely fact that existing product may need to be removed?

- Quality. Does it meet your standards for where you wish to place the product in your line-up?

- Saleability. Without looking at cost, would the product fetch a price point within your line-up that fills a need?

- Raw Cost. Does the cost before freight make sense based on what you believe you can sell it for?

- Landed Cost and Freight. Does the cost after freight make sense for your operation?

- Margins. Will carrying this product improve your overall gross margin?

- MAP (Minimum advertised price). If there is MAP pricing, do the margins improve your overall margins?

- Online pricing. What is the range and degree to which the product is priced by others online?

- Required investment. What are the requirements for the initial investment in terms of floor space, number of SKUs and dollars.

- Reorder lead time. How long does it take on average for stock orders vs custom orders.

- Vendor stock. Does the supplier maintain stock, and how transparent is that inventory.

- Reorder quantity. What are the options with reorders? Are there discounts or surcharges depending on order size?

- Container and domestic options. What are the options for containers with regard to mixed product? Are there domestic alternatives?

- Average Turns. On average, how many turns can be expected from this line? (Turns = Typical cost sold in one year / Average landed cost carried)

|

"Considering these other

factors will lead to higher profitability and inventory turns which is ultimately what businesses need if they want to outperform their competition." |

- Expected GMROI. Taking the above into consideration, what do you realistically expect your return on investment to be? (GMROI = Typical margin dollars for 1 year / Average landed cost carried)

- Terms. When and how is payment due? Is there a discount for paying early? What are the retractions for late payment?

- Co-op and rebates. Are there any funds available for advertising? Are there rebates as a buying group member or other affiliation?

- Marketing. To what extent if any is the vendor advertising?

- Product Simplicity. What is the degree of complexity associated with selling and ordering the product?

- What product training is included and what can be expected regarding ongoing training?

- Market exclusivity. Is there market protection or will the vendor sell to others in your distribution zone?

- Service. What is the service resolution process for product issues? Is a discount available in lieu of submitting vendor charge backs?

- Technology. How advanced is the technology used by the vendor for ordering and selling?

- Sales Rep Quality. Who will service the account and what will their commitment be?

- Brand Visibility. How well known is the brand to the public? Does it have a following that will attract customers?

- Supplier Anonymity. Is the supplier unknown and usable as a “private label” option?

- Line-up depth. How many SKUs does the vendor currently offer?

- Line-up introductions and discontinuations? How often does the vendor augment their line-up?

- Trust. How solid is the supplier's reputation?

- Geo-political exposure. To what degree is the supplier at-risk for price and supply chain disruptions?

Do The Math

| "Even if you don't do

the math and just think about the list of selection criteria you are likely to make better choices." |

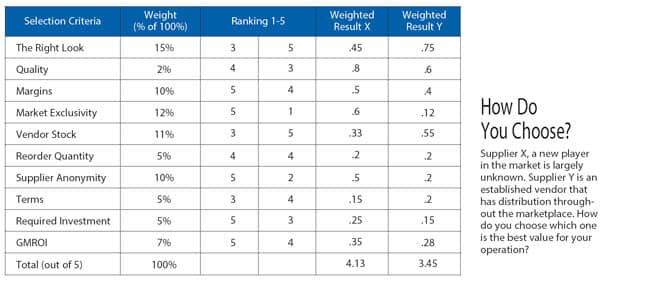

These 30 supplier selection criteria and related questions should be weighted depending on their importance to the individual retail business model. First, choose which of these are more and less important by assigning a percentage weight. When all the criteria are added, the total should be 100 percent (see chart).

Once this is accomplished, you can rank suppliers under consideration on each of your chosen criteria on a scale of one to five, with one being poor and five being excellent. The next step is to multiply each of your one to five rankings by the percentage you assigned to each selection criteria. Add up all the results and you have a weighted ranking for selecting suppliers. The ones that have the highest totals in the areas that matter most to you are the ones that you should carry.

"Add up all the results

and you have a weighted ranking for selecting suppliers. The ones that have the highest totals in the areas that matter most to you are the ones that you should carry."

This process is a more scientific approach for choosing suppliers. Even if you don't do the math and just think about the list of selection criteria you are likely to make better choices for your business.

Example

Suppose you are looking for a supply chain option to boost your margin without a lot of risk associated with carrying significant initial inventory. You have chosen 10 selection criteria that are most relevant in your search. Not all criteria are equal however. So you assign a weight out of 100 percent to each criteria. Supplier X, a new player in the market is largely unknown. Supplier Y is an established vendor that has distribution throughout the marketplace.

Using the method described earlier in this article, you ask questions and assign a value using 1 to 5 star rankings. Calculations are shown in the chart on page 23 for the following criteria and questions:

The Right Look: Supplier X is a wild card whereas Supplier Y is proven. Supplier X would add a new type of look to your line-up whereas Supplier Y is more like what you sell already. So, you rate Y at .75, higher than X at .45.

Quality: Supplier X's products have nicer workmanship and materials while Y seems lesser so.

Margins: Both suppliers can deliver decent margins, however, X appears to have better landed costs.

Market Exclusivity: This is an important factor in your decision. Supplier X will not sell to anyone else in your market place provided you are making routine purchases and keep current with payables. Supplier Y does not enter into exclusivity agreements and some of your competitors carry the line.

Vendor Stock: Supplier Y has a proven supply chain developed both domestically and internationally. Product is available via quick ship (for a higher price) or container purchase (at a reduced price). Supplier X, being new on the domestic scene, promises this, but is unproven. X could have supply issues if it grows too fast or encounters manufacturing issues.

Reorder Quantity: Both suppliers allow for no minimum orders and have container purchase options.

Supplier Anonymity: Supplier X is new and would be perfect for private labeling. Supplier Y is common amongst retailers and consumers are starting to recognize the brand.

Terms: Supplier Y offers 45 days payment terms from invoice date (shipping date) on domestic stocked goods. X wants full payment on shipping, but will negotiate to net 30 days.

Required Investment: Supplier X just wants to get into your line-up and is willing to do so with a minimum number of SKUs. A much more significant initial dollar spend would be required to floor and inventory supplier Y.

GMROI: Due to the opportunity for a large margin and small inventory, the return on investment possibility looks excellent for Supplier X. Y has the potential to return very good GMROI as well.

"After multiplying each

criteria score with your assigned weight and tolling up the results, you find thatX is the winner over Y. Supplier X has a weighted five-star ranking of 4.13."

Bottom-line

After multiplying each criteria score with your assigned weight and tolling up the results, you find that X is the winner over Y. Supplier X has a weighted five-star ranking of 4.13. Supplier Y has 3.45. This does not mean that X will work out of course. Anything could happen. However, going through a selection process such as this forces retailers to do some homework ahead of an investment. It increases the chances of success. When you do find a supplier that checks most of your important boxes and delivers on “the promise”, it is gold.