Changes coming from Apple and Google promise to rock the ecommerce industry, creating opportunities and challenges for home furnishings retailers.

This installment in Furniture World’s 2021 series on retail advertising features information and advice from Eric Grindley, Founder and CEO of North Carolina-based Esquire Advertising. His agency recently partnered with Furniture First, the cooperative national home furnishings and mattress buying group serving full-line independent retailers.

After leaving a job in the music industry to pursue a law degree, Grindley was hired as general counsel for an internet marketing company to work on legal and compliance issues. “On the compliance side,” he recalled, “I became aware of the huge problem with fraud that exists in online advertising.”

He then moved on to start and grow a series of companies focused on email marketing, Facebook marketing and, finally, affiliate marketing. Then, in 2015 he founded North Carolina-based Esquire Advertising.

Fraud Free Digital

“From the start, our focus was on the question of how to achieve fraud-free advertising. In fact, there are only a few main ways to get there. The best is to target the individual devices households use after confirming that those devices belong to specific households and are not a fake account, a bot or a click farm.”

Grindley says that the worst day a marketer can have is to “get stuck in a stream of fraudulent traffic. Once you get caught in that stream, because of the way the algorithms work, you tend to keep optimizing yourself back into that same bad traffic.

“The way to get better results is to target people in a customized way, both from an engagement and a conversion standpoint.”

New Mover Marketplace

“Our tracking data shows that big-box retailers are gobbling up market share in a lot of markets. And, they are holding up to, and in some cases, over 80 percent of consumers who visit. That’s a big problem for independent retailers who need to find ways to fight back.”

There is a massive amount of moving going on. Marketing to movers he says, “is what these independent retailers should do going forward. Normally, we see a peak in household movement during the summer months. In 2020, it started in October and November when we normally see a reduction in movers. The numbers also increased in February. They are trending correctly now that we are getting into the traditional moving season.

“The mover marketplace spends nine times more than average customers. These households need lots of furnishings, especially if they’re moving from an apartment in a big city like New York to a three-or four-bedroom house in the suburbs. Any furniture retailer who can reach out to these households and provide them with the right offers will do well.

The ecommerce

industry is about to be rocked like it’s never been rocked before. That’s because Apple and Google have plans to eliminate cookies.

|

“Sales data shows that after an initial purchase, movers often purchase again within 12 to 18 months from the same retailer. Building brand loyalty when someone is new to an area has a long-term value that’s hard to obtain otherwise. That’s another reason retailers need to be talking to everybody new to their markets.”

Unexpected Mover Patterns

“The mover data is interesting in other ways,” Grindley explained. “The data shows mass mover populations in areas we wouldn’t normally see. For example, I recently spoke with a retailer who saw about 25,000 new households coming into their trading area—Mobile and Pensacola. Even smaller cities in this trading area had substantial mover populations. That’s perhaps 2,000 movers per month in some smaller markets that have been up for grabs. With those kinds of numbers, one advertising campaign focused on the highest quality new households can allow a store to grow. It all starts with identifying where the mover population is.”

Data Collection

Grindley suggests that retailers in markets where there isn’t a big influx of movers should perform a full sales data analysis to understand where their best customers are coming from, and to find out what makes them tick.

Most retailers don’t know that online ads can be optimized for in-store sales. It’s one of the most powerful tools used today in marketing.

|

“Without that data,” he observed, “there’s no alternative but to target everybody. Targeting everyone in a DMA with a big TV buy sounds good in theory, but costs a ton of money and reaches lots of irrelevant people. Reaching out to highly targeted audiences—the 2,000, 3,000, or 4,000 people needed for a retail furniture business to grow—is a much better strategy. Some furniture retailers waste $40,000 or $50,000 a month on ineffective ad campaigns. Often, they are stuck in traditional approaches including direct mail, newspaper ads, google listings and circulars.”

Finer Targeting Is Key

“Most retailers don’t know if their advertising choices are working. Another problem arises when they rely on cookie-based demographics. I’ve yet to find anyone who has done an analysis of their cookies and found the information to be accurate. Most retailers guess and hope that their creative will get results. They may look at furniture shopping behavior to identify people. It’s better than just picking a zip code, but still isn’t targeted enough.

“Retailers should be looking at OTT (over-the-top) as an alternative to traditional television. At least with OTT, individuals can’t fast-forward through it.”

Top 100 Strategies

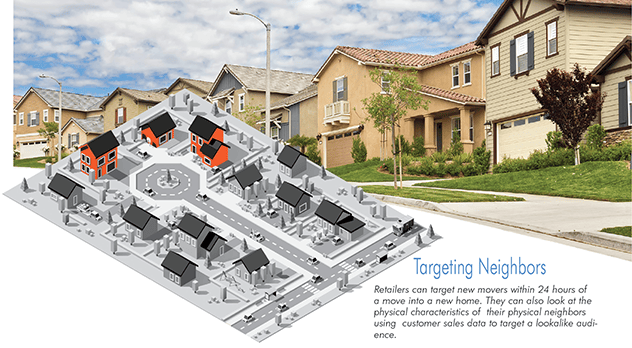

“Top-100 retailers that are going after new movers in their marketplaces with digital advertising can target them within 24 hours of a move into a new home. These retailers can also look at the physical neighbors of movers using past customer sales data to target a lookalike audience.

“Instead of trying to do this with cookie-based data, it’s better to use a real-world scenario to find movers who are likely to be solid customers. That’s possible because movers generally look like their neighbors, have similar incomes, houses, cars, kids who go to the same schools and shop at the same stores.

“This analytics-based approach has proven to be quite successful. It minimizes the problems with digital advertising I mentioned at the beginning of this interview because instead of optimizing to clicks, click-through rates or foot traffic, these retailers are optimizing to shoppers’ characteristics that ring the register.

“Most retailers don’t know that online ads can be optimized for in-store sales. It’s one of the most powerful tools used today in marketing, a technique that was previously reserved for use by the biggest stores and ecommerce giants.”

Optimizing Ads to Sales

Grindley said that any sized brick-and-mortar store can now do this.

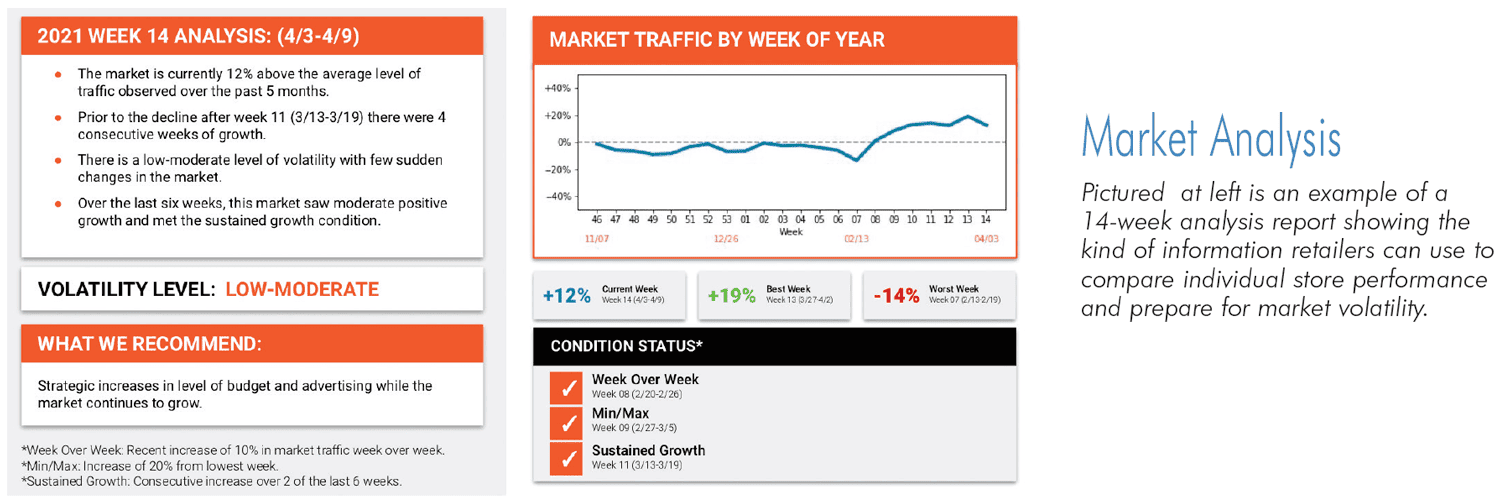

“The process starts with an analysis of a retailer’s sales data—demographics and household information—to create customer profiles for individual store locations. Even if you have five stores, I can guarantee you that each store will have customers who have a different overall profile. Addressing those differences can be the distinction between a really good campaign and a really bad one. The next step is to develop campaign recommendations based on the economy, the market, the competition in that market, and an analysis of the sales data to determine where the store performs the best from an audience standpoint.

“Armed with this information it’s possible to select the best audiences—for example—new movers, digital neighbors, in-market shoppers or past customers. Custom targeted campaigns can also be created to sell individualized products.

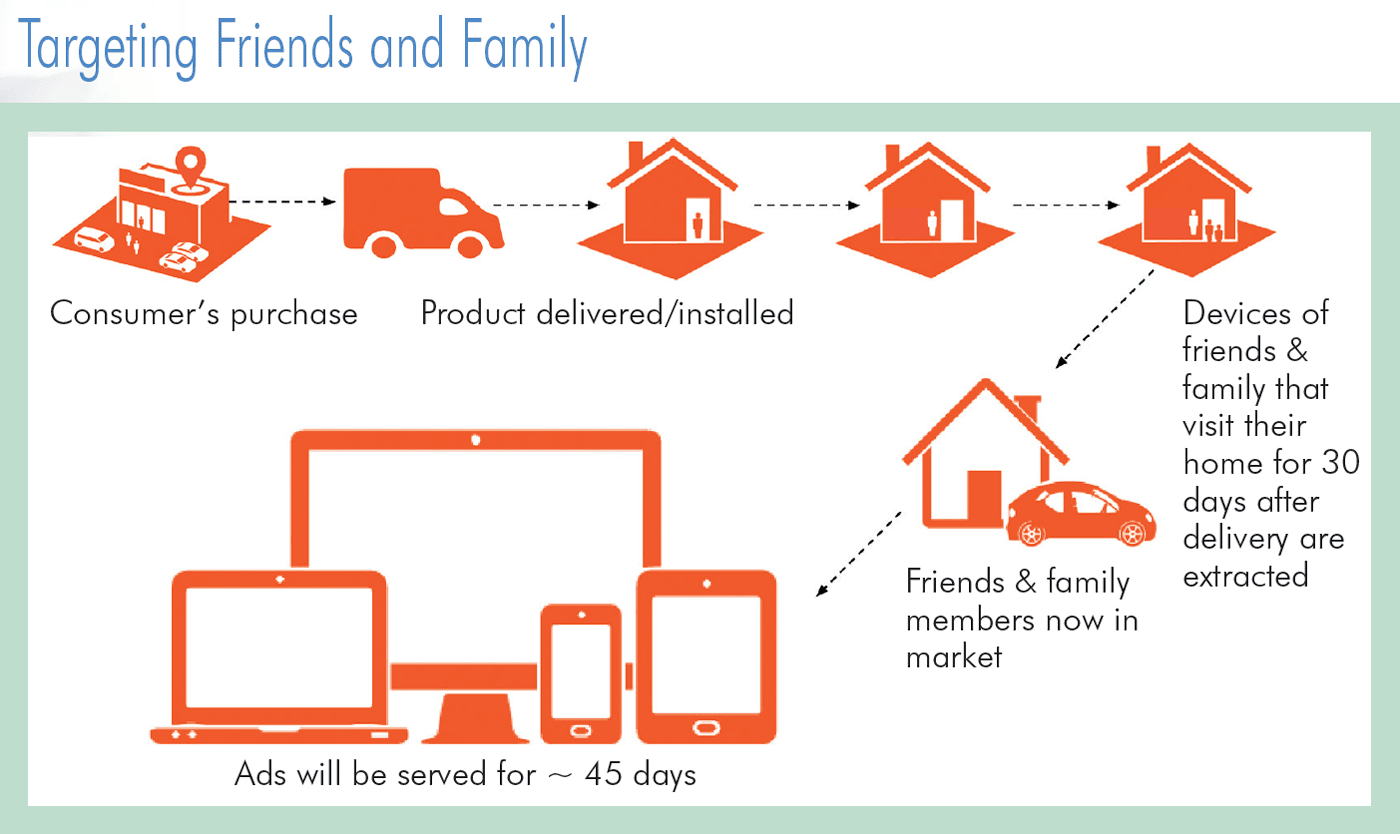

“Retailers have also been successful at turning recent purchasers into influencers. The idea is to identify people that recent customers interact with—including friends and family—then serve ads to this inner circle to get them to come in and buy.

“The final step is to build out the campaign assets, create an ad campaign, and match up in-store sales data to delivered online ads.”

Targeting Devices & People

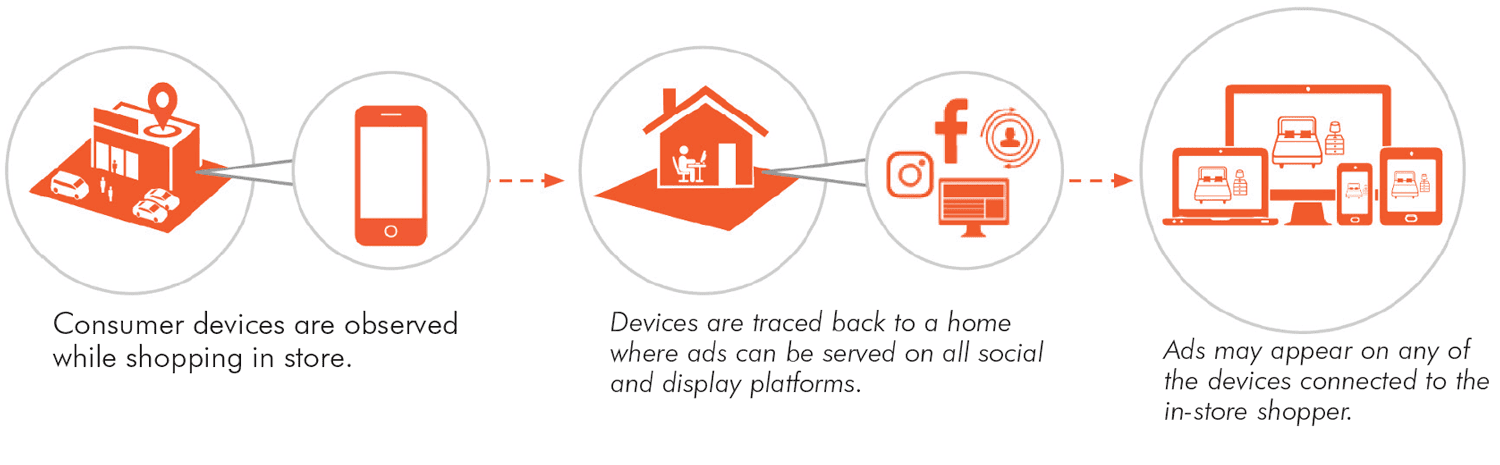

“It is possible to identify and target all internet-connected devices within a home, plus monitor those devices to track where people in a specific household shop. For example, an Ashley Furniture retailer might see that 10 percent of its customers are also shopping at Conn’s Home and 20 percent are going to World Market.”

Grindley says that knowing how competitors are doing is vitally important in today’s marketplace. “If a retailer is having a down weekend, week or month,” he said, “you don’t have to guess whether or not it’s due to poor performance at your store alone or if everybody’s sales are down. It’s also possible to see exactly what’s going on inside competitive stores—where they’re getting their foot traffic from and what the people in those zip codes look like. If that same Ashley store, mentioned above knows that a competitor is getting 70 percent of its business from particular zip codes, they can target additional marketing dollars to those zip codes. That has the effect of disrupting the competitor’s business and growing their own. Tools like this applied daily give smart retailers a significant advantage,” he added.

“Having this kind of information also results in cost savings. If that same Ashley retailer knows that 70 percent of its business comes from one zip code, there are two ways to look at it. That zip code could be targeted heavily to further build market share or a decision could be made to focus marketing dollars on their second, third, fourth or fifth best zip code.

Sales data shows that after an initial purchase, movers often purchase again within 12 to 18 months from the same retailer.

|

“The alternative to gaining insight from this kind of information is to advertise on TV, billboards, radio or direct mail to reach zip codes that account for less than one percent of the foot traffic in an entire marketplace.”

Brand Messaging

Is there no place for broad-based brand messaging? Grindley said that depends on the brand. “Consumers engage with retailers in different ways. It’s a decision to be more product-focused or brand and lifestyle-focused. The majority of buyers in the market for furniture watch HGTV. They see amazing designs, but they don’t know how to replicate those looks in their homes. Therefore, some of the best messaging today is focused on selling the dream. That message can be delivered with digital and traditional media. But, if a retailer knows that a potential customer has just moved into their area, just got married, divorced or experienced other big life-changing moments, there are opportunities to communicate digitally in a way that will better engage with them.”

Other Opportunities

Online Shopping Formats:“There’s an opportunity,” he said, for furniture retailers and manufacturers to invent an online shopping format. “I envision a live home shopping network-type streaming format. In this scenario, consumers could tour stores, hear about specific products and how those products fit into rooms to create dream homes. This format is getting traction online, especially in the retail clothing space. It’s only a matter of time before someone in the furniture industry figures out how to do it well, perhaps targeting consumers with an interesting 30- to 60-minute format and the right spokesperson.”

Ecommerce: “One problem with the furniture industry is that very few furnishings retailers have original website designs. Substantial modifications of the code are difficult. Even modifying the SEO on those sites can be limited. For the majority of retailers though, it’s enough because, quite honestly, most retailers are not going to compete effectively in the ecommerce space.

“Not every retailer can start an ecommerce site and be successful. Most know how to run a brick- and-mortar company, but those who try to compete directly with Amazon, Wayfair and Overstock are fighting a losing battle. The answer for brick-and-mortar stores is to find the right consumers from their market who want to try out that $2,000 couch before they buy it. Many more people are buying online but there’s still a large population who, when exposed to the right message, want to shop locally.”

Cooperative Advertising: “Another challenge for furniture retailers is to get control of their cooperative marketing programs with manufacturers. Most manufacturers have no visibility into where their co-op money is going, how it is being spent, if it is being spent, or the effectiveness of dollars invested.

“We work with retailers who are having difficulty getting reimbursed for co-op advertising. Manufacturers make them jump through hoops to get reimbursed. And, when these expenses are denied, retailers often don’t know the reason why.

“Manufacturers want retailers to use the dollars effectively for obvious reasons.” Grindley went on to explain that there is a real benefit to getting co-op advertising under control for both furnishings retailers and manufacturers. And that this is especially true for companies that don’t have the marketing staff to keep track. “Those retailers need to be able to see in black and white how many co-op dollars they’re accruing, what they have to spend, and get control of the payments. I think we are going to see more manufacturers sign on to consolidated co-op marketing programs to create visibility for both retailers and manufacturers.”

Important Changes

“Market and consumer analytics that monitor consumer shopping behavior—follows where they go and what they do—is going to keep getting better. But all the data in the world does nothing for a retailer unless they know what it means and how to use it. The ones that understand and can act upon it, will prosper; the ones that can’t figure it out, won’t.

“Most retailers think they know who their consumers are. Lots of assumptions are made. But typically, when we dive into the data and look at the customers who visit a retailer’s store and purchase, it’s a different story.

It is possible to

identify and target all internet-connected

devices within a home, It’s one of the most powerful tools used today in marketing.

|

“It’s the same situation with competitive stores. More often than not, furniture retailers have at least three or four retailers in their market that they don’t consider competitors. But looking at the data, the opposite is often true. This is a missed opportunity to address sales that are going to a direct competitor or one that sells a single product category.

“This type of information is valuable to the sales staff as well. If your sales associates know that half of the customers have either visited or will visit a competitor down the street, they can adjust their sales presentations to point out your advantages such as better pricing and in-stock availability. But to do that they have to understand your marketplace, where people are going and how they’re shopping. Only then can they close more deals while they have their consumers in the store.

“The ecommerce industry is about to be rocked like it’s never been rocked before,” warns Grindley. “That’s because Apple and Google have plans to eliminate cookies. They’ve indicated that they will take away everything that ecommerce retailers use to figure out who to target, how to optimize, and how much to spend on advertising. When these changes take place, online retailers won’t spend the same amount of money online, because they won’t know if it’s converting or not.”

He believes that there will be a mass exodus of small ecommerce retailers, which will open a window for local retailers that don’t rely on Facebook or Google’s data to find the right people.

“This will create an opportunity for brick-and-mortar retailers to shine because fewer consumers will be targeted with ecommerce advertisements and there will be more advertising inventory on the market. Local retailers will be able to come in with a message about local support, delivery, service and responsiveness. It will be an opportunity to communicate with customers better than huge national companies.”

Conclusion

“Now is the time to start exploring new opportunities. Retail owners and managers should ask their marketing and agency people how they plan to adapt. Most retailers have been living in a cookie-dependent world, and when they are eliminated in the next six months, retailers need to have a plan to do something about it.”

Russell Bienenstock is Editor-in-Chief of Furniture World Magazine, founded 1870. Comments can be directed to him at editor@furninfo.com.