Interview with Chip West

Research shows

that more diversification in media buys can be beneficial for many

furniture retailers.

For this installment in Furniture World’s series on advertising best

practices, we interviewed Chip West, director of category strategy for

the national sales team at Vericast, a marketing solutions company.

Vericast helps businesses across many industry verticals, including

grocery, consumer packaged goods, restaurant, retail, and financial

services connect with consumers through data, analytics, and a broad

portfolio of digital, print and payment solutions.

“Our company started in the print space,” West explained. “We were and

continue to be the largest shared mail advertiser in the USA. Furniture

and bedding retailers and their ad agencies use our distribution

platform to co-mingle messages in shared packaging targeted to about 70

million households weekly down to the neighborhood level across the

country.

“This covers most DMAs across the country, with content that can be

customized by neighborhoods, and we have access to vast amounts of first

and third-party data, often incorporating unique data from our furniture

retail partners that help us develop targeted approaches to reach their

customers.

“Over time, the platform has evolved with patented technology, including

digital infrastructure to deliver offline and online solutions helping

clients and shoppers connect.”

A Diversified Ad Spend

When asked to share the major advertising deficiencies among furniture

retailers today, West observed that many retailers don’t diversify their

media enough. “Instead,” he said, “they choose to put all their eggs

mostly in one basket. That’s probably not the right approach in today’s

world. Consumers engage with a lot of media throughout the day,

ingesting a huge amount of information online, print, and broadcast. All

this information affects their decisions about which furniture stores to

visit. There’s a lot of data suggesting that the more media a retailer

layers in to connect through multiple media channels, the better the

response is likely to be.”

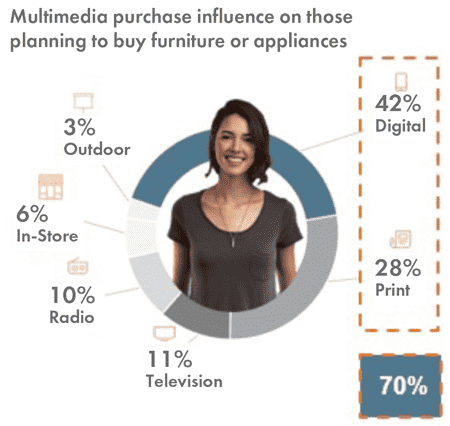

70% of purchase influence is driven by print and digital media.

70% of purchase influence is driven by print and digital media.

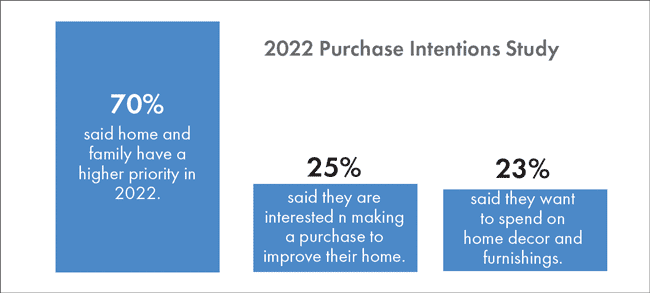

Consumer Spending For 2022

“Our studies show that 70 percent of consumers agree that spending on

home and family will have an even higher priority in 2022 than in 2021.

Roughly 23 percent said they planned to purchase home decor and

furnishings. Therefore, omni-channel approaches are critical to reaching

out to furniture shoppers.

“When making advertising decisions,” he continued, “it’s important to

consider the difference between engagement and influence. Just because

you may consume a lot of a particular medium doesn’t necessarily mean

you are influenced by it.

“Other studies show what influences consumers when they’re making a

purchase. Prosper Insights & Analytics, a well-known data company,

reported that 70 percent of the media’s influence on those planning to

buy furniture and mattresses comes from print and digital components

(Source: Prosper Insights & Analytics, 2021).

“That statistic suggests furniture retailers whose media investments are

too heavily weighted toward broadcast are likely to sacrifice market

share among consumers already thinking about or shopping for furniture.

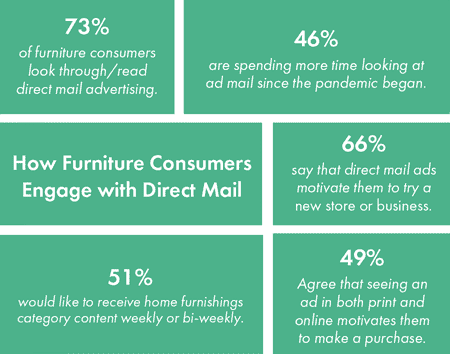

“We all know that over the years, newspaper readership has declined.

According to research by Nielsen Scarborough, a company that collects

local and national consumer insights, 74 percent of U.S. households have

not read a newspaper in the past week. However, nearly half of recent

furniture purchasers say that they spend more time with advertising mail

than before the pandemic. Advertising mail is tangible and has longer

shelf life than other media. It makes a lot of sense because buying

furniture is a purchase that requires ideation and research. This is

reflected in sales data from home furnishings retailers collected over

time following the release of a print mailer.

Source: Vericast Awareness-to-Activation Study, October 2021

Source: Vericast Awareness-to-Activation Study, October 2021

“About half of furniture consumers surveyed say that seeing an ad both

in print and online motivates them to make a purchase. Online intent

signals can identify households in-market to buy furniture. Infusing

digital advertising is a great way to reach them with an additional

touchpoint. So, a strategy of having an always-on approach with digital

combined with print and other media has proven to be a terrific way to

bring in-store traffic and make more sales.”

Retail Messaging

Moving on to ad messaging in light of recent logistics and supply chain

challenges, Chip West mentioned that Vericast is encouraging retailers

to reconsider repeating pre-pandemic advertising messages.

“Retailers who have ample inventory and/or lines made in North America

will have continued success shouting that out. Retailers who have goods

that are in stock or minimally delayed have a distinct advantage worth

promoting. On the other hand, retailers that are not so lucky can focus

on a more limited selection of in-stock items or general messaging that

avoids traditional price/ item advertising.

“In 2021 and beyond, we saw advertisers continue to promote in-store

events and promotions focused during the tax-refund season. Not

everybody files their taxes at the same time, so the most successful

advertising ensures offers are delivered to shoppers at the same time

they get their refunds. That’s because those dollars get spent pretty

quickly.

“Inflation will make financing offers even more important, especially

for millennials who have purchased homes or plan to buy them in the

coming months. They are the largest share of home buyers today at 37

percent. Eighty percent of millennials are likely to make a major

purchase in the next six months. This group typically buys older homes

that need repair or renovation. Financing offers are an excellent way

retailers can get them into stores to buy furniture on an accelerated

timeline. Consider offers featuring home offices and furniture for

family and common, multi-use rooms.

Also, millennials are the largest group of new movers, the biggest

trigger for home furnishing purchases. Unfortunately, many furniture

retailers still don’t emphasize reaching new movers as much as they

should. So, it’s a big opportunity to bring in lots of new business.”

Other Advertising Considerations

West also commented on the following advertising considerations:

-

Website Messaging: Many retailers need to ensure

their websites better reflect the experience customers will have

when they visit their stores. It doesn’t matter what the mismatch

is; consumers want to see these two experiences tied seamlessly

together.

-

Recruiting: More furniture retailers should

consider leveraging their display ads, as appropriate, for

recruitment. This is more important than ever before due to the

current hiring environment.

-

Message Timing: Another important consideration for

advertisers is the timing of advertising offers. When extended

delivery times are a concern, retailers should let shoppers know

that they need to consider moving up their shopping timeline to

increase the chance of receiving goods intended for seasonal use or

in time for an upcoming life event.

-

Additional Timing Issues: Historically, a lot of

furniture stores focus their messaging to promote big three-day

weekends; Presidents’ Day, Labor Day, Memorial Day, Back-to-School,

Back-to-College, Thanksgiving, Christmas and Black Friday weekend.

Although October through December traditionally registers the

strongest sales for home furnishings retailers, it’s fairly

consistent from month to month when we look at the sales trend-line

for the year. Frequent messaging is especially important now to

reach ready-to-buy furniture shoppers as industry sales may be

softening.

There are so many life events that create selling opportunities. Moving

to a new home is a big one, but people need furniture when family

members move in or out, get married, downsize or make home improvements.

Any of these can trigger a need for new furniture. That is why we see

retailers getting better returns when they spread their messaging out

and use greater frequency to motivate consumers year-round.

Source: Vericast Consumers Studies (Recent Furniture Purchasers)

Source: Vericast Consumers Studies (Recent Furniture Purchasers)

released 2021 Study, October 2021

Questions about the topics covered in this interview can be directed

to Chip West care of

editor@furninfo.com.